In May 2015, Professor Thomas Pogge delivered the keynote address at a conference, titled “Financial Transparency and Human Rights in Africa: Fostering Greater National and Regional Economic Opportunity in Africa through Human Rights and Financial Transparency,” co-hosted by Global Financial Integrity, the Friedrich-Ebert-Stiftung (FES), and the International Bar Association’s Human Rights Institute (IBAHRI) in Johannesburg, South Africa.

A member of GFI’s Board of Directors, Dr. Pogge is the Director of the Global Justice Program and the Leitner Professor of Philosophy and International Affairs at Yale University.

Illicit Financial Flows “Greatly Aggravate Poverty and Oppression in Many Developing Countries”

GFI Estimates Illicit Outflows Drain 5.5% of GDP from Sub-Saharan Africa Annually

JOHANNESBURG, South Africa – International and African experts on human rights and illicit financial flows are convening in Johannesburg, South Africa this week for a multi-day conference on the linkages between financial transparency and human rights in Africa.

Hosted by Global Financial Integrity (GFI)—in partnership with the Friedrich-Ebert-Stiftung (FES) and the International Bar Association’s Human Rights Institute (IBAHRI)—the event builds upon the New Haven Declaration on Human Rights and Financial Integrity (New Haven Declaration), which recognized that “human rights and international financial integrity are intimately linked.”

Les flux financiers illicites « aggravent considérablement la pauvreté et l’oppression dans de nombreux pays en voie de développement.»

GFI estime que les sorties illicites de capitaux représentent 5.5% du PIB annuel en Afrique sub-saharienne.

JOHANNESBURG, Afrique du Sud – Des spécialistes internationaux et africains des droits de l’homme et des flux financiers illicites se réunissent cette semaine à Johannesburg, en Afrique du Sud, pour une conférence de plusieurs jours sur les liens entre la transparence financière et les droits de l’homme en Afrique.

Organisée par Global Financial Integrity (GFI) – en collaboration avec la fondation Friedrich-Ebert-Stiftung (FES) et l’institut des droits de l’homme de l’Association internationale du barreau (IBAHRI) – cet évènement s’appuie sur la Déclaration de New Haven sur les droits de l’homme et l’intégrité financière (Déclaration de New Haven), qui a reconnu que « les droits de l’homme et l’intégrité financière internationale sont intimement liés. »

Fluxos financeiros ilícitos “Agravam Muito a Pobreza e Opressão em Muitos Países em Desenvolvimento”

A GFI Estima que as Saídas Ilícitas Drenam 5,5% do PIB da África Subsariana anualmente

JOANESBURGO, África do Sul – Especialistas africanos e internacionais sobre direitos humanos e dos fluxos financeiros ilícitos reúnem-se em Joanesburgo, África do Sul esta semana para uma conferência de vários dia as relações entre a transparência financeira e os direitos humanos em África.

Organizada pela Global Financial Integrity (GFI) — em parceria com a Fundação Friedrich-Ebert-Stiftung (FES) e o Instituto de Direitos Humanos da International Bar Association (IBAHRI) —o evento baseia-se na Declaração de New Haven sobre os Direitos Humanos e a Integridade Financeira (Declaração de New Haven), que reconheceu que “os direitos humanos e a integridade financeira internacional estão intimamente ligados.”

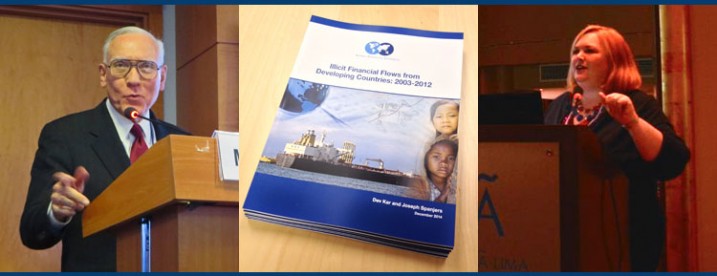

By Tom Cardamone, December 24, 2014

A Quarterly Newsletter on the Work of Global Financial Integrity from October through December 2014

Global Financial Integrity is pleased to present GFI Engages, a quarterly newsletter created to highlight events at GFI and in the world of illicit financial flows. We look forward to keeping you updated on our research, advocacy, high level engagement, and media presence. The following items represent just a fraction of what GFI has been up to since September, so make sure to check our new website for frequent updates.

World Bank Forum on Illicit Financial Flows

On October 11, GFI President Raymond Baker was a featured member of a World Bank panel, titled “Illicit Financial Flows and the Post-2015 Development Agenda,” which focused on the need to curtail the negative effects of illicit financial flows on sustainable development.

Held during the IMF/World Bank Annual Meetings, the public forum was hosted by the World Bank Group’s Integrity Vice Presidency and included high-profile speakers from Bangladesh, Denmark, Norway, and the Untied States.

By Channing Mavrellis, November 20, 2014

Whether South Africa’s Illegal Gold Mining Problem Is Measured in Revenue, Security Risks, or Human Lives—in the End, Everyone Loses

South Africa is the world’s fifth largest producer of gold, with the gold mining sector representing approximately two percent of South Africa’s GDP. Yet the country’s mineral wealth has proved to be a growing source of illegal activity and conflict.

There are approximately 14,000 illegal gold miners in South Africa, many of whom are illegal immigrants from Lesotho, Mozambique, and Zimbabwe. Illegal gold miners are known locally as “zama zamas,” which is variously translated as “We are trying” or “He who seizes the opportunity” or “Take a chance.” They operate in the estimated 4,000 to 6,000 abandoned mines in the Witwatersrand basin, but will also bribe security guards, policemen, or mine employees to gain access to active mines and/or to steal equipment. Credible estimates of the value of the illegal gold mining industry vary widely, ranging from US$500 million to US$2 billion annually.

Not included in these figures is the tax fraud involved in these activities. According to Naomi Fowler, criminal syndicates exploit the fact that value added tax (VAT) is not charged on mined gold whereas it is on processed gold. These syndicates then use techniques like trade misinvoicing to fraudulently certify illegally mined gold as legitimate second-hand scrap gold, which enables them to claim back VAT that they never paid.

The Right Leader for South Africa—and the World—at the Right Time

WASHINGTON DC – Global Financial Integrity today mourned the passing of civil rights leader and former South African President Nelson Mandela, who died yesterday at his home in South Africa at the age of 95. Global Financial Integrity expressed sympathy for the people of South Africa for losing an iconic leader.

After nearly three decades of imprisonment, Mandela was freed in 1990. He publicly responded with a message of reconciliation, rather than vengeance, and helped unite South Africa after the end of apartheid. Later, Mandela was elected as the first black President of South Africa, and pursued an agenda of social welfare and inclusion.