by Ben Iorio In November 2018, Global Financial Integrity published an analysis of South Africa’s potential revenue losses associated with trade misinvoicing, finding losses of approximately US$37 billion in revenue, or on average $7.4 billion between 2010-2014....

by Ben Iorio “The traditional thinking has always been that the West is pouring money into Africa through foreign aid and other private-sector flows, without receiving much in return. Actually, that logic is upside down – Africa...

By Ben Iorio On June 26th, Global Financial Integrity (GFI) published a comprehensive study estimating Egyptian revenue losses of approximately US$1.6 billion as a result of trade misinvoicing in 2016. By deploying a detailed analysis of the...

By Tom Cardamone, July 9, 2019

As scores of government representatives gather at the UN this morning for 10 days of high-level discussions on the current progress of the Sustainable Development Goals (SDGs), the elephant in the room is how developing and emerging...

By Ben Iorio Baca dalam Bahasa On June 23rd, Global Financial Integrity (GFI) published a comprehensive study estimating the amount of revenue losses Indonesia incurred as a result of trade misinvoicing in 2016. By analyzing data published...

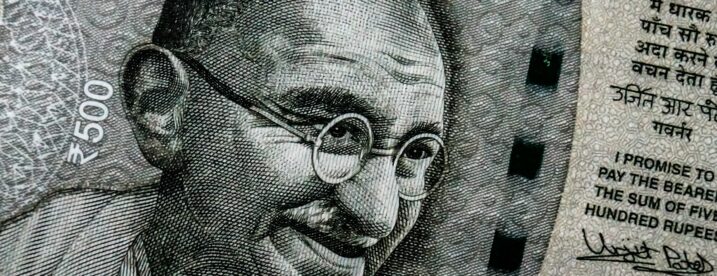

Global Financial Integrity estimates India lost US$13.0 billion in potential revenue to trade misinvoicing in 2016 alone. How did we get that estimate? This blog breaks down the findings and methodology of our latest report.

By Joseph Spanjers, November 9, 2016

Today, GFI is pleased to announce the launch of GFTrade, a proprietary trade risk assessment application that enables customs officials to determine if goods are priced outside typical ranges for comparable products. A cloud-based system developed over the past year, GFTrade provides officials with real-time price analyses for goods in the port using price ranges for the same product based on global trade information. This information can help to determine if further investigation into potential misinvoicing is warranted, and it has the potential to substantially increase domestic revenue mobilization.

By Raymond Baker, October 21, 2016

Global Financial Integrity is pleased to note growing interest in the estimation of illicit financial flows and their effect on emerging market and developing countries. We are writing to offer a series of thoughts surrounding the reality of this concern and its political significance.