By Daniel Neale, January 6, 2019

If ever there was the need to showcase the extent to which there is an endemic problem surrounding money laundering at large banks, look no further than 2018.

High Level Engagement Foundazione Centesimus Annus Pro Pontifice In May, GFI President Raymond Baker participated in the annual meeting of the Foundazione Centesimus Annus Pro Pontifice at Vatican City. On the second day, Raymond...

By Raymond Baker, June 5, 2017

Thank you. I am very grateful for the opportunity to participate in CAPP Foundation’s 2017 conference. This morning we are focusing our attention on human smuggling and economic crime, as Lord Skidelsky will focus our attention this afternoon on incentivizing solidarity and civic virtue.

By Sami Dabbegh Since the outbreak of the so-called “Jasmine Revolution” five years ago, leading to the ouster of former president Ben Ali, Tunisia’s key economic and social problems have not been tackled in a way that...

By Tim Hirschel-Burns “A global human society, characterised by islands of wealth, surrounded by a sea of poverty, is unsustainable.” This quote from Thabo Mbeki, the former president of South Africa, concludes the recently released video “Stop...

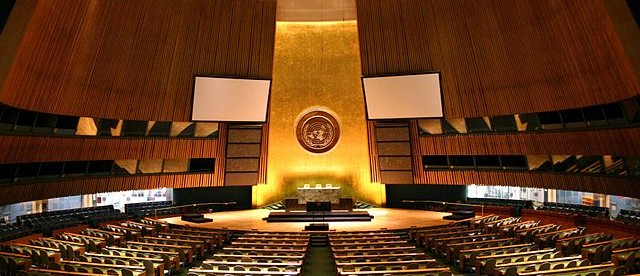

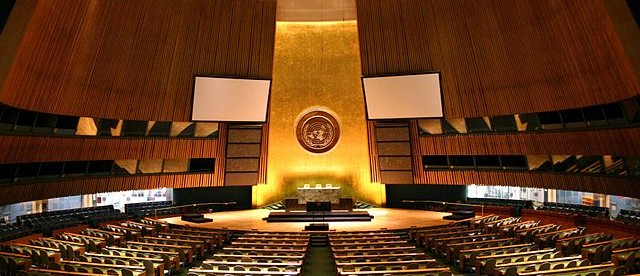

On February 1st through 2nd, I and other youth representatives from around the world met at the UN’s ECOSOC Youth Forum to discuss how we can actively influence the implementation of the recently adopted Sustainable Development Goals (SDGs). A highlight of the event was a speech by Mr. Ahmad Alhendawi, the UN Secretary-General’s Special Envoy on Youth, who argued for his “Ten Myths about Youth,” in which he asserted that youth are not the future, seeing as we comprise so much of the world today and are directly and immediately affected by any decisions that take place. Youth are as much the present as any other group in society—participating youth repeatedly expressed their concerns about the current lack of employment opportunities (in advanced and developing economies alike). High levels of youth unemployment are correlated with major losses in human capital development, income and employment stability, and aggregate economic gains.

For over a decade now, various global initiatives have promoted the design and implementation of international standards for governments and companies in the extractive sector to publish detailed information about their output and revenues. In 2002, after major corruption scandals emerged in Angola, Publish What You Pay (PWYP; a global coalition of civil society organizations) demanded oil, gas and mining companies to publish what they paid governments.

By Tom Cardamone, October 6, 2015

A Quarterly Newsletter on the Work of Global Financial Integrity from June to September 2015

Global Financial Integrity is pleased to present

GFI Engages, a quarterly newsletter created to highlight events at GFI and in the world of illicit financial flows. We look forward to keeping you updated on our research, advocacy, high level engagement, and media presence. The following items represent just a fraction of what GFI has been up to since March, so make sure to check our

website for frequent updates.

Global Financial Integrity Conference: Illicit Financial Flows: The Most Damaging Economic Problem Facing the Developing World

Based on the culmination of work GFI has done with the support of the Ford Foundation including a book by GFI, the conference included discussions and keynote remarks from experts on the nature of IFFs, country-level perspectives, and how and why curtailing these IFFs should be a priority for the global community.