By Daniel Calingaert, June 6, 2024

The global system of financial secrecy is a cancer on democratic institutions and a drain on economic development, yet to date only a handful of experts have called for its elimination. It merits far greater attention and...

By Tanner Clegg, June 26, 2023

Corruption is never a victimless crime. This is especially true for those who bear the brunt of arms trade corruption.

By Katherin Alfonso, Tanner Clegg, November 22, 2022

As the best empirical data unfortunately indicate, violent conflicts are on the rise. After a precipitous drop in civil wars following the dissolution of the Soviet Union, the number of active intrastate conflicts has ballooned over the...

By Matthew Baur Massive cargo ships are all too familiar to those living in big port cities. These giant vessels deliver goods needed for much of our society to function, from medical supplies and medicines, to food...

By Brooke Tunstall Corporate tax avoidance is an open secret in the world of multinational enterprises. Hiding behind loose laws and revenue reporting standards around the globe, these international corporations obscure profits and losses to a degree...

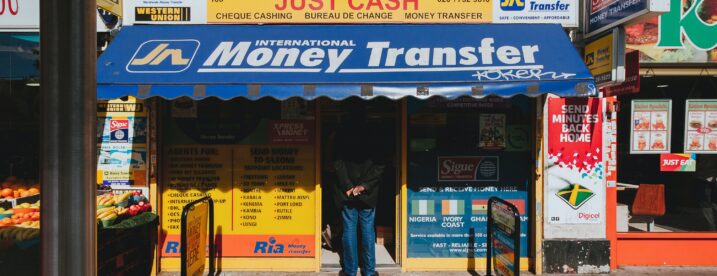

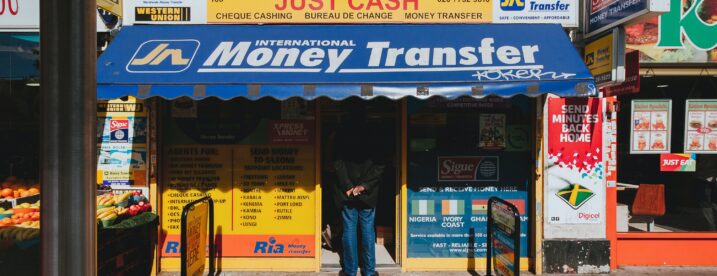

By Julia Yansura and Laura Porras Today, June 16th marks the International Day of Family Remittances, dedicated to recognizing the contributions of the international migrants who send over US$550 billion home to developing countries each year. And...

Editor’s note: this piece was originally published in the Financial Times on July 25, 2019. The July 24 Opinion piece “Multi-firm audits can break the Big Four’s oligopoly” by Joseph Smith rightly points out that effective and...

By Tom Cardamone, April 3, 2017

Believe it or not, the Panama Papers scandal has an upside: it shed light on the dark corners of the international financial system. Prior to the revelation that one law firm helped establish over 200,000 anonymous companies, the casual observer knew tax evasion, corruption, and money laundering occur in the world but they didn’t know quite how it works. Now the term “anonymous shell company” has some resonance and it is in the general lexicon — even if most people still can’t explain how they work.