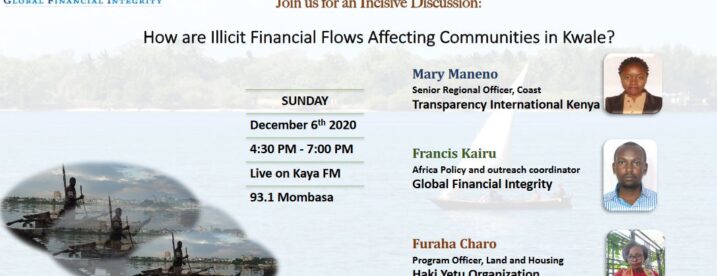

By Francis Kairu, Mary Maneno and Furaha Charo GFI jointly with Transparency International Kenya (TI-K) and Haki Yetu organized the third radio show in this series to discuss the impact the IFFs have had on Kwale County....

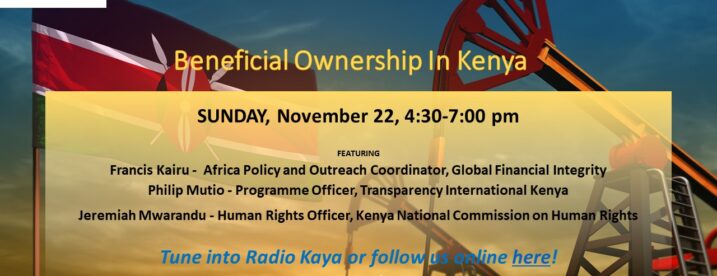

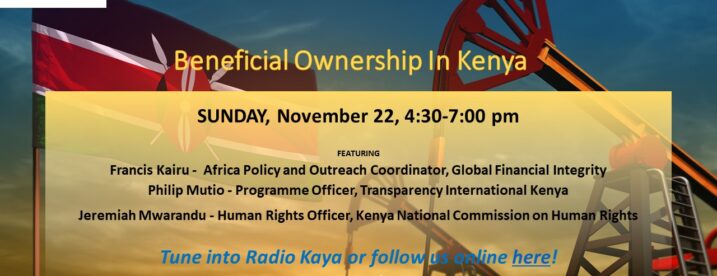

By Francis Kairu and Philip Mutio Global Financial Integrity organized the second radio show in a series of 3 that discussed beneficial ownership in Kenya. The show was held on Kaya FM one of the leading stations...

By Francis Kairu, December 15, 2020

With support from Norwegian Agency for Development Cooperation (NORAD), GFI organized a series of Swahili radio shows aimed at building community knowledge and understanding of illicit financial flows (IFFs) and the linkages to corruption and beneficial ownership....

We have a big year planned for 2020. From advocacy and research, to panel participation and other high-level engagements, check out some of the projects we’ll be working on this year: Advocacy In 2019, we began advocacy...

New Study Shows Kenya Trade Misinvoicing Leads to Significant Revenue Losses Misinvoicing of Imports and Exports Approaches 1/4 of all Trade Transactions WASHINGTON, DC – Analysis of trade misinvoicing in Kenya in 2013 shows that the potential loss...

By Grace Zhao, July 14, 2014

Don’t get too excited about Kenya’s removal from the Financial Action Task Force’s (FATF) gray list.

The FATF list of “high risk and non-cooperative jurisdictions” is a list of countries that the organization believes to be doing very little in the global fight against money laundering and terrorist financing. The list is based off a series of 40 recommendations that it expects countries to abide by to reduce money laundering and terrorist financing. These recommendations include, among other things, the regulation of banks and other financial institutions. Countries that do not adequately address these expectations are placed on the black or gray list based on varying degrees of compliance.

In 2010, FATF placed Kenya on a list of high risk countries for delays in enacting laws to tackle criminal financial activity as well as a failure to track money laundering.

By E.J. Fagan, May 21, 2014

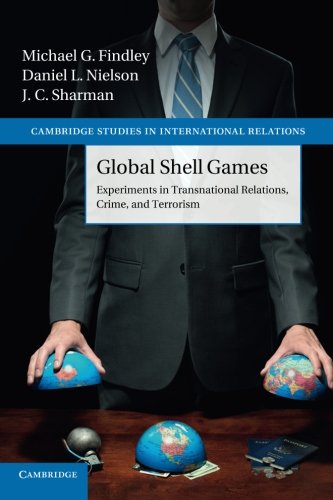

On Friday, Global Financial Integrity hosted professors Michael Findley and Daniel Nielson to talk about their new book, Global Shell Games, Experiments in Transnational Relations, Crime, and Terrorism.

On Friday, Global Financial Integrity hosted professors Michael Findley and Daniel Nielson to talk about their new book, Global Shell Games, Experiments in Transnational Relations, Crime, and Terrorism.

The book follows their ground-breaking paper, Global Shell Games: Testing Money Launderers’ and Terrorist Financiers’ Access to Shell Companies, which was published in 2012. The authors approached nearly 4,000 services in over 180 countries in a random assignment experience designed to measure how difficult it was to convince a corporate service provider or law firm to create a shell company without proper identification.

Political scientists Mike Findley and Daniel Nielson discuss the findings of their new book: Global Shell Games: Experiments in Transnational Relations, Crime, and Terrorism, and the issue of anonymous shell companies. They are joined by Global Financial Integrity’s Heather Lowe, who moderates the event, as well as by Tax Justice Network-USA’s Jack Blum.

On Friday, Global Financial Integrity hosted professors Michael Findley and Daniel Nielson to talk about their new book,

On Friday, Global Financial Integrity hosted professors Michael Findley and Daniel Nielson to talk about their new book,