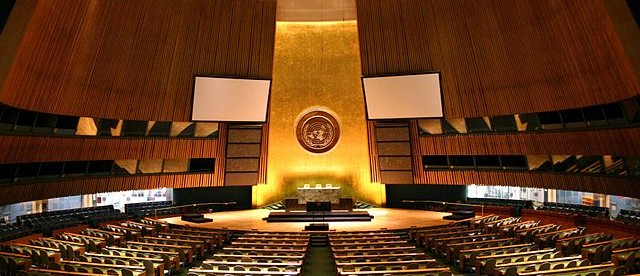

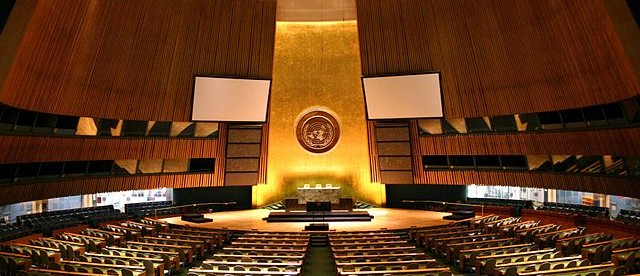

On February 1st through 2nd, I and other youth representatives from around the world met at the UN’s ECOSOC Youth Forum to discuss how we can actively influence the implementation of the recently adopted Sustainable Development Goals (SDGs). A highlight of the event was a speech by Mr. Ahmad Alhendawi, the UN Secretary-General’s Special Envoy on Youth, who argued for his “Ten Myths about Youth,” in which he asserted that youth are not the future, seeing as we comprise so much of the world today and are directly and immediately affected by any decisions that take place. Youth are as much the present as any other group in society—participating youth repeatedly expressed their concerns about the current lack of employment opportunities (in advanced and developing economies alike). High levels of youth unemployment are correlated with major losses in human capital development, income and employment stability, and aggregate economic gains.

For over a decade now, various global initiatives have promoted the design and implementation of international standards for governments and companies in the extractive sector to publish detailed information about their output and revenues. In 2002, after major corruption scandals emerged in Angola, Publish What You Pay (PWYP; a global coalition of civil society organizations) demanded oil, gas and mining companies to publish what they paid governments.

By Tom Cardamone, February 1, 2016

In adopting the Sustainable Development Goals this past September, UN member states realized two extraordinary achievements. First, the document itself—with 17 goals, 169 targets and 200+ (yet to be finalized) indicators—is a testament to global ambition, a 15-year roadmap toward what is hoped will be unprecedented progress in poverty alleviation. Second, the global community agreed to “substantially reduce illicit financial flows,” which reached $1.1 trillion two years earlier according to a recent GFI study.

By Dev Kar, January 22, 2016

Several recent studies have indicated that capital flight (defined as outflows of licit and illicit capital from developing countries) has serious consequences for economic performance and well-being. For example, a 2012 IMF study based on a panel regression of 103 developing countries over 2001-07, found that country-specific factors such as institutional quality and domestic credit markets have little impact on a country’s ability to translate capital inflows into domestic investment.