Using Tech To Help Banks Stop The Bad Guys

By Lionel Bassega, November 24, 2020

Global trade is widely recognized as the lifeblood of a growing economy. However, according to the Wolfsberg’s Group Trade Finance Principles, financial institutions involved in trade financing cannot easily identify instances of over- or under-invoicing (or any other misrepresentation of value) by consulting trade documents alone. The inability to easily and accurately determine the value of goods for which letters of credit are sought exposes the bank to the risk of being used to move money illicitly across borders through trade misinvoicing.

Trade misinvoicing involves the deliberate manipulation of the value of a trade transaction by falsifying, among others, the price, quantity, quality, and/or country of origin of a good or service by at least one party to the transaction. GFTradeTM is a cloud-based risk assessment application developed by Global Financial Integrity to detect trade fraud. The system enables trade finance and compliance teams to determine if the declared value on trade finance applications is outside typical ranges for the same product between the same two trading partners. Detection of pricing anomalies will significantly reduce a financial institution’s risk of reputational damage and serious civil and criminal penalties. GFTradeTM is an essential tool to assist financial institutions in conducting due diligence investigations and minimizing exposure to potential illicit activity, particularly as a first line of defense.

How GFTradeTM Works

Using an API, GFTradeTM is integrated into a bank’s operating systems to ensure all trade finance applications received by the bank are automatically checked by the tool, so misinvoicing is easier to detect. This helps to improve efficiency in the processing of trade finance applications as more focus and scrutiny will be placed on applications or commodities identified as likely posing a high risk of misinvoicing, whereas low-risk applications or commodities will be quickly approved, saving time and energy. GFTradeTM has the most up to date trade data for 43 of the world’s largest trading nations including the U.S., China, Japan and all Eurostat countries so there is a high probability the tool contains the information required to verify the cost of the goods being financed.

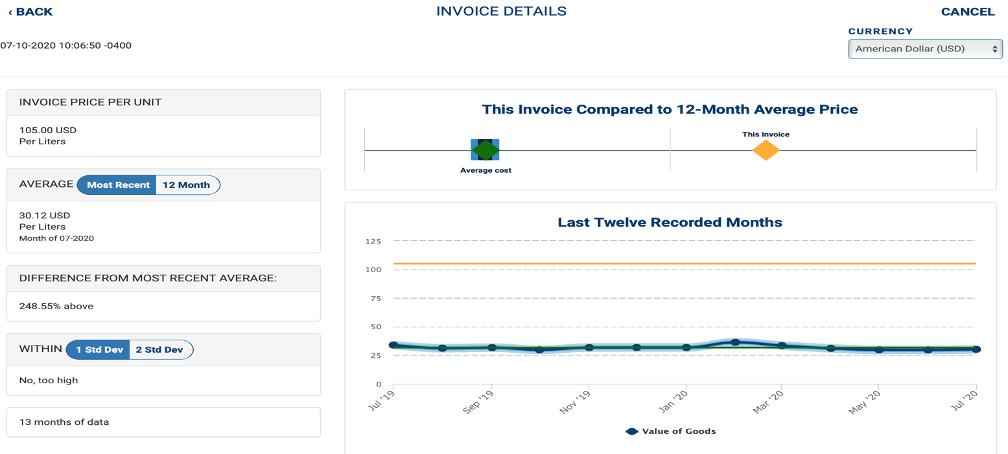

For example, let’s assume an American businessman importing 5,000 liters of wine from France applies for a trade finance amount of US$525,000 from his bank. In this hypothetical case, the US bank uses GFTradeTM to conduct due diligence on the likely cost of the goods. Since GFTradeTM is already integrated into the bank’s operating system, as soon as the customer submits his application to the bank, the application is automatically checked for misinvoicing by GFTradeTM. The system immediately provides a visual comparison between the unit price of the commodity declared on the trade finance application, against the average unit price and the most recent average price reported by the partner country over the past 12 months as shown below. This enables the trade finance analyst to make a quick and accurate decision as to the validity of the stated value:

In this example, the declared value of the wine is clearly out of synch with recently prevailing prices. Notably, the price declared on the trade finance application is 248.55 percent above the most recent average price, as shown in the table on the left of the graphic. This is also visible in the chart, where the orange line, representing the price declared on the trade finance application, is well above the green line depicting the 12-month average price. This suggests the transaction has been over-invoiced. Therefore, the analyst has to further investigate this before taking a decision on the trade finance application.

The tool is updated automatically each month with no technical requirements by the end-user. Trade data is provided at the tariff-level (8-, 9-, and 10-digit codes) to ensure maximum accuracy in average pricing and trade data for additional countries is available upon request. GFTradeTM provides accurate results efficiently, consistently and with minimal training for a trade financing risk solution suitable for any institution providing letters of credit.

For more information, or a demonstration of GFTradeTM contact

Lionel Bassega: lbassega@gfintegrity.org