By Tom Cardamone, December 24, 2014

A Quarterly Newsletter on the Work of Global Financial Integrity from October through December 2014

Global Financial Integrity is pleased to present GFI Engages, a quarterly newsletter created to highlight events at GFI and in the world of illicit financial flows. We look forward to keeping you updated on our research, advocacy, high level engagement, and media presence. The following items represent just a fraction of what GFI has been up to since September, so make sure to check our new website for frequent updates.

World Bank Forum on Illicit Financial Flows

On October 11, GFI President Raymond Baker was a featured member of a World Bank panel, titled “Illicit Financial Flows and the Post-2015 Development Agenda,” which focused on the need to curtail the negative effects of illicit financial flows on sustainable development.

Held during the IMF/World Bank Annual Meetings, the public forum was hosted by the World Bank Group’s Integrity Vice Presidency and included high-profile speakers from Bangladesh, Denmark, Norway, and the Untied States.

By Raymond Baker, December 19, 2014

Dear Friends,

Best wishes for a wonderful holiday season.

At Global Financial Integrity, we’ve had another tremendously successful year. On the global stage, many countries are now planning to begin exchanging financial information automatically by the end of 2017 or 2018. Just this week, the European Union agreed to end the incorporation of anonymous companies with the EU. The global community is actively discussing whether a goal to reduce illicit financial flows should be included in the upcoming Sustainable Development Goals.

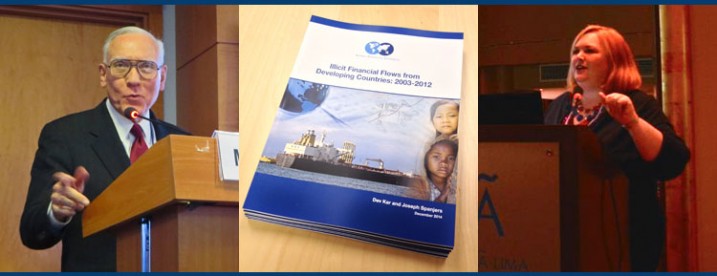

That said, as our flagship annual report—published this week—on illicit financial flows from developing countries shows, the developing world continues to lose US$1 trillion per year in illicit outflows, and they are growing at roughly twice the rate of global GDP. More must be done.

While GFI’s work has a tremendous impact, we have done all of this with only about 10 staff members and a very modest budget, which significantly hinders the impact that we can have. Just imagine what we could do with a larger budget to leverage our groundbreaking global economic research and policy advisory work with governments.

By Liz Confalone, December 5, 2014

Slow but Steady Progress towards Curtailing the Abuse of Anonymous Companies

In June 2013, G8 leaders met in Lough Erne and agreed to a set of principles on beneficial ownership transparency. The principles state that companies should maintain their beneficial ownership information and that the information should be available to law enforcement and other competent authorities; additionally, countries were to consider making such information available to financial institutions and other regulated businesses. Trust information should be collected and available, the principles explained, but only to law enforcement. These principles were largely reiterated by the Financial Action Task Force (FATF)—the body setting international anti-money laundering standards—in their Guidance on Transparency and Beneficial Ownership in October 2014 and by the G20 in their High Level Principles on Beneficial Ownership in November 2014.

Despite the establishment of this baseline, momentum is building since Lough Erne to raise the bar. In July 2013, the UK began the process to establish a central register of information and, after a public comment period, determined that the register should be publicly available—a position strongly supported by Global Financial Integrity (GFI). In April 2014, the European Parliament approved provisions requiring formation of public registers as part of their draft of the European Union’s Fourth Anti-Money Laundering Directive (AMLD), but the E.U. Council and the E.U. Commission have yet to take a public position on the AMLD, delaying its final adoption. Just last month, Denmark announced that it, too, would create its own public registry of beneficial ownership information.