December 14, 2022

Washington, D.C. – The Caribbean has seen an uptick in financial crimes, including fraud schemes, in recent years. Financial fraud has a widespread footprint across the region, involving hundreds of millions if not billions of dollars in illicit proceeds each year, impacting the economic security of countries and the region as a whole, and generating a certain level of associated violence.

The new Global Financial Integrity report, Financial Fraud in the Caribbean, examines the prevalence and dynamics of this financial crime. It analyzes the actors and facilitators involved, the methods of contact used by perpetrators, and the channels utilized to move the associated proceeds. It also assesses current policy and law enforcement responses. In addition, the report provides five country case studies, examining the country contexts in Antigua and Barbuda, Barbados, Belize, Jamaica, and Trinidad and Tobago.

The report draws on interviews with subject matter experts from law enforcement, financial intelligence units (FIUs), financial services commissions (FSCs), multilateral organizations, the private sector, and the media. Utilizing the interviews as well as background research, the report i) considers the effectiveness of the region’s response to fraud, specifically exploring the success of the national and/or regional efforts, ii) scrutinizes the source of those weaknesses as well as iii) evaluates performance in four key areas: prevention, detection, investigation and prosecution.

The following are some of the key observations made in the report:

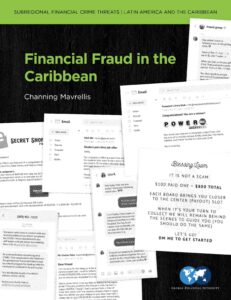

- The most common fraud types in the Caribbean include advance fee frauds, specifically lottery/prize scams, online shopping scams, and romance scams, as well pyramid and Ponzi schemes.

- Pyramid schemes in the region frequently take advantage of citizens’ comfort and familiarity with “sou-sous”, a legitimate, informal community savings practice.

- The method of contact between victim and fraudster is oftentimes dependent on the type of fraud being committed, the sophistication of the schemes and the type of victims involved. For example, lottery scams are largely phone-based while romance scams are perpetrated online and through social media.

- The primary channels used to move the proceeds of fraud are cash smuggling, money service businesses, bank transfers, trade-based money laundering, and online money transfer platforms, according to interviews with subject matter experts.

- Caribbean countries have laws in place to cover the types of fraud discussed in this report, however many countries face challenges when translating these laws into effective enforcement actions.

- The prevention and investigation of fraud in the region faces cultural barriers. Some citizens may incorrectly perceive governments’ efforts to combat fraud as an attempt to prevent them from making money. Others may be hesitant to report fraud victimization due to cultural stigma.

- In Jamaica alone, experts assessed the annual value of fraud proceeds at up to US$800 million.

Selected recommendations for the public and private sectors include:

- While awareness campaigns are being used to sensitize citizens to risks, the public and private sectors should take additional steps to assess and improve the effectiveness of these campaigns.

- Given the prevalence of investment fraud schemes, governments should make it easy for potential investors to verify those individuals and companies registered to conduct business in a jurisdiction.

- Prosecutors working on fraud cases should explore using tax legislation when civil asset forfeiture is not available.

- Policymakers should evaluate current consumer protection legislation for potential improvements.

- Countries in the region should create courts that only address financial crime cases.

- Recognizing that all jurisdictions face financial crime threats, the private sector should take steps to assess and mitigate risk in a nuanced, evidence-based manner, avoiding “de-risking.”

This report is part of a larger project by GFI that analyzes financial crimes in Latin America and the Caribbean. The project’s first report, Financial Crime in Latin America and the Caribbean: Understanding Country Challenges and Designing Effective Technical Solutions covered financial crime trends throughout the hemisphere. It looked at illicit proceeds from corruption, drug trafficking, mineral trafficking, trafficking in persons, and smuggling of migrants. Continuing with this effort, this report is part of a newly four-section initiative to understand financial crime threats in the hemisphere.

Para leer el comunicado de prensa en español haga click acá.

###

ABOUT GFI: Global Financial Integrity is a Washington, D.C.-based think tank, producing high-caliber analyses of illicit financial flows, advising developing country governments on effective policy solutions and promoting pragmatic transparency measures in the financial system to promote global development and security.

CONTACT:

Channing Mavrellis

Illicit Trade Director

@IllicitFlows

@cmavrellis