In 2007, the IMF offered what has become a generally-accepted definition of offshore financial centers (OFCs): “An OFC is a country or jurisdiction that provides financial services to nonresidents on a scale that is incommensurate with the...

The terms “tax haven” and “secrecy jurisdiction” often refer to the same thing: physical locations characterized by laws and structures that promote secrecy. This secrecy enables wealthy individuals to hide financial assets from tax authorities and other...

If you live in the United States, the phrase “tax haven” might bring to mind palm trees, sand lodged in toe crevices, and small countries brimming with peculiar corporate offices. If you live in Europe, you may...

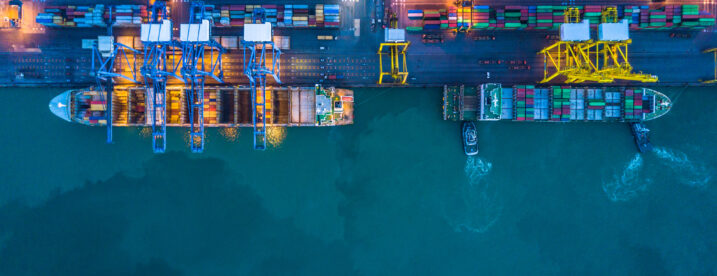

Trade integrity is defined as international trade transactions that are legitimate, properly priced and transparent. Supporting and implementing policies to promote trade integrity can create permanent change by helping governments to significantly curtail illicit financial outflows so...

Trade misinvoicing is a method for moving money illicitly across borders which involves deliberately misreporting the value, volume, and/or type of commodity in a commercial transaction on an invoice submitted to customs. A method used to shift value through international trade, trade misinvoicing is the largest component of illicit financial outflows measured by Global Financial Integrity.

Most crimes committed in the world are crimes of greed. Transnational criminal networks can generate huge sums of money, and—like any other business—they require access to the international financial system in order to conduct their complex and far-reaching operations.