Solutions for Inspired Economies

Trade misinvoicing has impacted emerging market and developing countries for decades by siphoning capital out of economies and denying governments vitally important domestic resources. This phenomenon is utilized for the purpose of 1) manipulating VAT taxes, customs duties, income taxes and other sources of revenue for Governments, and 2) shifting money into or out of countries in a manner that cannot be easily detected.

This reality may be manifested through:

Import Over-Invoicing

Import Under-Invoicing

Export Under-Invoicing

Export Over-Invoicing

The drainage of money out and the loss of revenue in emerging market and developing countries is in the hundreds of billions of dollars annually.

Solutions for Inspired Economies is a three-part program addressing this reality. Each part may be undertaken individually, or simultaneously, or in any order. The three components are:

Economic Analysis

Policy Dialogue

GFTrade Global Trade Pricing Database

The following materials present details on each of these components of the Solutions for Inspired Economies package.

[wptab name=’Economic Analysis’]

Economic Analysis

Global Financial Integrity (GFI), with years of experience analyzing trade data, undertakes an in-depth analysis of a country’s misinvoicing problem. Data is drawn from two sources:

International Monetary Fund Direction of Trade Statistics

United Nations Commodity Trade Statistics Database

IMF Direction of Trade Statistics (DOTS) presents data on a country’s bilateral trade with its trading partner countries. With this data source GFI is able to appraise the magnitude of trade misinvoicing impacting a country and in many cases detect with which trading partner countries misinvoicing is most frequently evidenced.

UN Commodity Trade Statistics Database (UN Comtrade) presents bilateral trade data by country and by Harmonized System commodity code identification, enabling further examination of bilateral trade discrepancies and scrutiny of which commodity groups reveal misinvoicing most frequently.

Utilizing these two sources of data, GFI produces a thorough analysis of the magnitude of a country’s misinvoicing problem. We can determine how much of the problem stems from import over- or under-invoicing or export under- or over-invoicing. With a sufficiently long time series of data, we are often able to measure how economic and political events have influenced misinvoicing. Across shorter time periods we can estimate what revenues have been lost to Governments. And we are often able to measure the relationship of illicit financial flows through trade misinvoicing to other factors such as foreign direct investment, tax policy, social expenditures, and inequality.

The Economic Analysis provides a useful first step in determining how a country may progress in curtailing its trade misinvoicing problem.

[/wptab]

[wptab name=’Policy Dialogue’]

Policy Dialogue

Global Financial Integrity’s (GFI’s) team of experts works in a dialogue on a confidential basis with senior officials of Governments to consider specific policy measures that can be undertaken to curtail the reality of trade misinvoicing and improve domestic resource mobilization. GFI’s team includes experts in economics, law, customs, trade, banking, accounting, auditing, tax, and anti-money laundering. We request that Government counterpart teams be drawn from ministries of finance, trade, economic development, and resources as appropriate and include officials from revenue authorities, the central bank, customs, ports, intelligence units, and such other organs of Government as are deemed appropriate.

The Policy Dialogue comprises four steps:

Preparation: The host country provides to GFI its up-to-date legislation in force encompassing customs

regulation, taxation, anti-money laundering, banking, exchange control, anti-corruption, and incorporation and corporate filing requirements. GFI reviews this material in depth and prepares the agenda for discussion.

First Meeting: A two-day discussion held in Washington D.C., addressing issues surrounding the curtailment of illicit financial flows through trade misinvoicing. Among the issues addressed are the following:

Legislation establishing that trade misinvoicing is illegal.

Requirements on commercial invoices.

Obligations placed upon corporate executives.

Obligations of auditors and accountants.

Treatment of services and intangibles.

Enhanced scrutiny of tax haven transactions.

Automatic exchange of financial information with other governments.

Beneficial ownership information on companies.

Country-by-country corporate reporting requirements.

Treatment of politically exposed persons.

Export processing zones and/or bonded warehouses, if applicable.

Statistical issues.

Following the two-day discussion, GFI provides to the Government a summary of the talks and policy issues and recommendations for further consideration by the Government.

Second Meeting: Upon returning home, the Government expert team holds meetings, including with additional advisory officials as may be needed, to consider the points and measures emerging from the first meeting. This process may proceed for three to six months.

When the host country is ready, GFI’s expert team travels to the country for a second round of two-day meetings. In these discussions, Government officials present their appraisal of the feasibility of implementing various policy measures to curtail trade misinvoicing and elaborate on such steps as may have already been taken. GFI reacts to the successes achieved and issues remaining.

Follow Up: After the conclusion of the Second Meeting, GFI remains available for an extended period of time for further exchange of views on measures that can be taken to curtail illicit financial flows due to trade misinvoicing. In addition, GFI advises on emerging new concepts and practices that may be helpful to the host country.

GFI approaches the whole of this four-step process in confidence. Governments are free to publicize the effort at their discretion.

[/wptab]

[wptab name=’GFTrade’]

Trade Misinvoicing and Trade Based Money Laundering Risk Assessment

Section 1 – General Overview

GFTrade is a proprietary risk assessment application that enables customs officials to determine if goods are priced outside typical ranges for comparable products. The system provides officials with real-time price comparisons for goods in the port with price ranges for the same product, traded between the same two trading partners during the previous year, based on global trade information which can be used to determine if further investigation is warranted. The system is fed by the most recent official trade data from China, the United States, EU28, and Japan and provides the ability to search for goods values based on thousands of Harmonized System (HS) codes. GFTrade is an essential tool to assist governments in maximizing domestic resource mobilization and tackling trade misinvoicing.

Trade misinvoicing—which involves the deliberate falsification of the value or volume of an international commercial transaction—is the largest component of illicit financial flows measured by Global Financial Integrity (GFI), which was close to US$1 trillion for developing countries in 2015. GFI estimates that on average over 80 percent of such illicit financial outflows were due to the fraudulent misinvoicing of trade.

By fraudulently manipulating the price, quantity, or quality of a good or service on an invoice submitted to customs, criminals can easily and quickly shift substantial sums of money across international borders. Trade misinvoicing occurs in all countries and for various reasons including to evade tax and/or customs duties, to launder the proceeds of crime, to circumvent currency controls, and to hide profits offshore, among others. In developed nations revenue losses due to trade misinvoicing and the ramifications of trade-based money laundering—including its possible connection to terrorist financing—is significant. In developing and emerging market nations trade misinvoicing can drastically undermine domestic resource mobilization efforts which weakens a government’s ability to build the economy and alleviate poverty. Given that rates of tax collection in developing nations tend to be well below those seen in developed nations, the loss of revenue due to trade misinvoicing has a corrosive impact on development.

Section 2 – Application

An example of how the system works is seen in the screen shot below. In this hypothetical case, a customs official in Durban, South Africa can compare the price of hydraulic machinery imported from the United States against a range of pricing for the same product imported from the U.S. over the past 12 months, based on information in the database. To begin, the official will input an HS Code for a specific product (i.e. hydraulic machinery – 842129) and select from the search results the commodity that most closely matches the information on the shipment’s customs document.

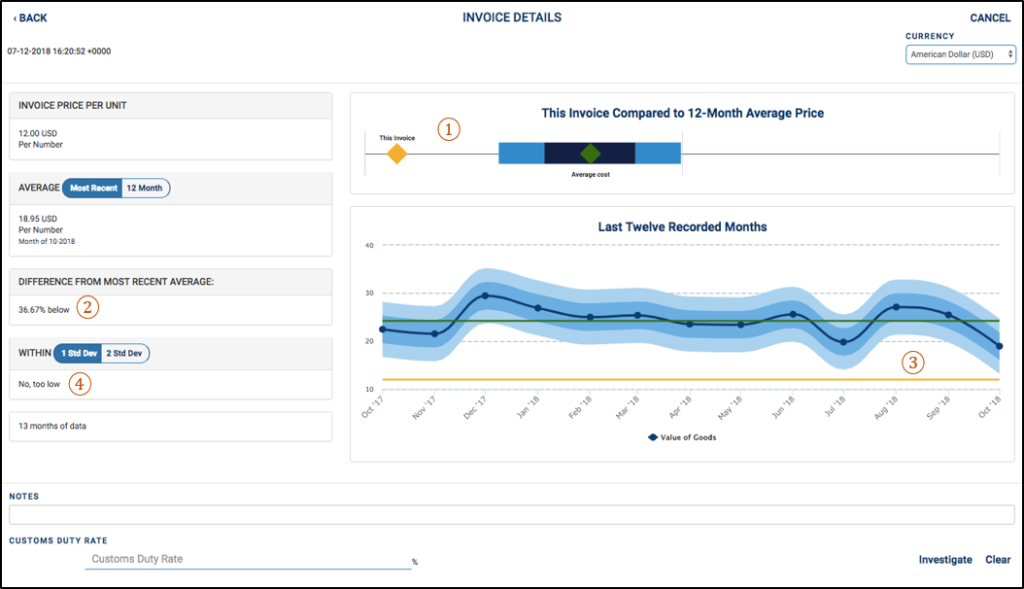

Having selected a commodity, the user will be able to compare the range of previous pricing from a specific country against a live trade invoice. To do so, a customs official will input the total value of the shipment he/she is processing and GFTrade will return a visual comparison of the unit price of that shipment with the average price for the previous 12 months. For the purposes of this hypothetical example we have inputted a unit price of $12 per unit. This is visualized as follows:

Figure 1: Price comparison visualization

The figure above provides four ways to determine if a product in the port is priced within a typical range. The first way to make a determination is seen at the top of the screen where the yellow diamond indicating “this invoice” is compared to current average pricing using a plot line. The greater the distance to the left of the diamond representing the “average cost” shows the degree of under-pricing and the greater the distance to the right of that point indicates the degree of overpricing. In this case, the yellow diamond indicating “this invoice” is well to the left of the 12-month average price (green diamond) thereby indicating that this invoice price is lower than the usual range of prices for this product. The second way to make this determination is seen to the left of the screen under the heading “Difference With Most Recent Average” which notes that the current invoice value is “36.67% below” most recent monthly average price ($18.95).

The third way to indicate invoice pricing variations from the norm is represented by a solid yellow horizontal line which compares to the floating monthly average price for the previous 12 months as well as to the 12-month average price ($24.20) represented by the solid green horizontal line. The gap between the solid yellow horizontal line and the solid green horizontal line provides a clear indication the invoice is below average pricing. This is seen again in the fourth indicator (on the left margin), which refers to one and two standard deviations (both high and low) from the most recent average monthly price. The standard deviations for the previous 12 months are represented in the diagram by the two lighter blue bands. It should be noted that the standard deviations can be used as the outer range of acceptable risk whether it be above or below the average price but these are subjective distinctions and for customs departments to determine its risk sensitivity.

After analyzing the information above, the user may then proceed to either clear the shipment or flag (bottom right corner of the screen shot) it for additional price verification and investigation. It is highly recommended that all users input the customs duty rate (bottom left corner) for a particular commodity prior to flagging a transaction, as this data can provide the system with information that can subsequently be used to calculate differences in revenue collected from flagged transactions.

Section 3 – Users and Use Environments

GFTrade can be utilized by the following departments:

- Customs Department – Determine if imports are priced within a normal range (while the goods are still in the port) to assess if the correct amount of duties are being paid.

- Central Bank – Determine if exports are priced within a normal range (before goods are exported) to determine if the proper amount of hard currency is entering the country.

- Transfer Pricing Unit – The tool allows for an analysis of pricing for goods that have been traded between related parties to determine if arms-length prices were used.

- Law & Revenue Enforcement/Investigation Units – The database assists in determining if trade/customs fraud, TBML, VAT fraud or income tax evasion might have occurred based on unit price comparisons.

Section 4 – Data Sets Incorporated

GFTrade incorporates official data from 31 countries, including eight of the world’s 10 largest trade economies (by volume): China, United States, Germany, Japan, France, United Kingdom, the Netherlands, and Italy. The database is updated monthly with official government statistics from all 31 countries. These updates occur automatically with no technical requirements by the end-user. To ensure maximum accuracy in average pricing, goods in are sorted by the global standard 6-digit HS codes with ability to use 8-, 9-, and 10-digit HS codes as well.

Section 5 – Benefits

GFTrade provides the following benefits to users:

- Accuracy: Real-time pricing on tens of thousands of products from 31 of the world’s top trading nations.

- Efficiency: The system enables customs officials to quickly clear low-risk transactions and place greater focus on commodities presenting an indication of misinvoicing.

- Speed: Results provided instantaneously – won’t delay movement of goods.

- Consistency: Product pricing information updated monthly. – Ease of training & Use: Price inquiries take just seconds to enter and price comparisons displayed five ways.

- Security: Password protection and server firewalls prevent data leakages.

- Value: Very high return on investment.

For more information or a demonstration of GFTrade, contact President and CEO Tom Cardamone at tcardamone@gftrade.org

[/wptab] [end_wptabset skin=”default” ]