Addressing Transparency Challenges in Latin America and the Caribbean: A Closer Look at Corporate and Tax Transparency

Robust transparency mechanisms are key to preventing illicit financial flows. In particular, identifying the real or “beneficial” owners of corporate structures can help to effectively prevent financial crimes, including tax fraud, in the Latin American and Caribbean...

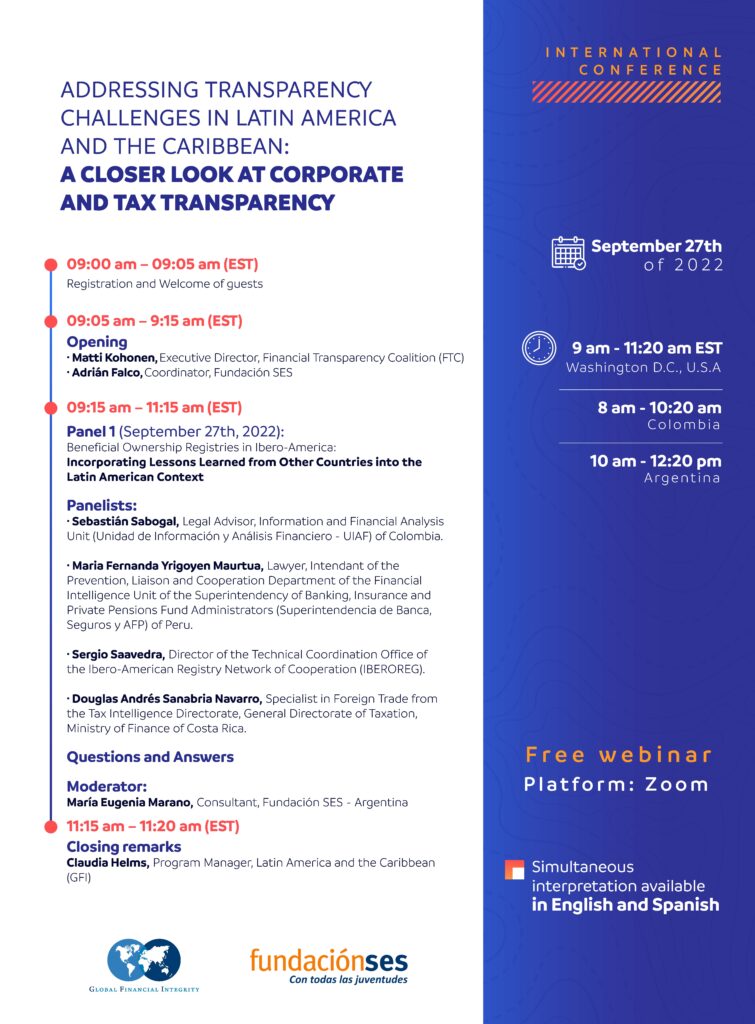

Event Details

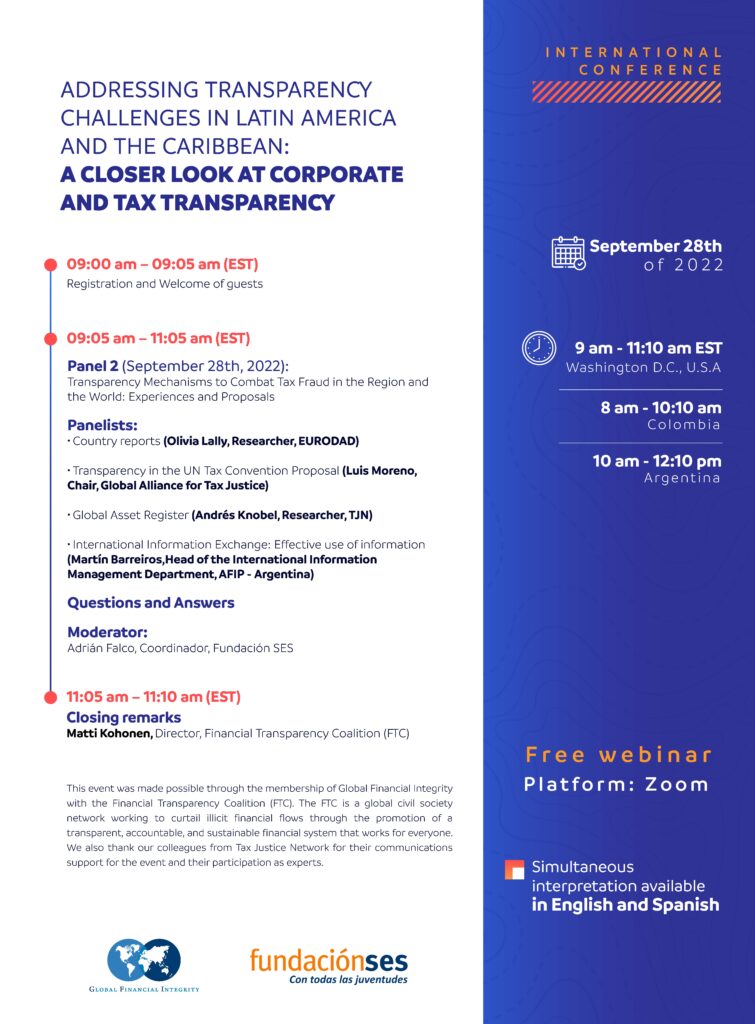

September 28, 2022

Robust transparency mechanisms are key to preventing illicit financial flows. In particular, identifying the real or “beneficial” owners of corporate structures can help to effectively prevent financial crimes, including tax fraud, in the Latin American and Caribbean region.

Global Financial Integrity and Fundación SES will present a two-panel conference on corporate and tax transparency, including international cases, lessons learned and strategies going forward.

Panel 1 (September 27th, 2022):

Beneficial Ownership Registries in Ibero-America: Incorporating Lessons Learned from Other Countries into the Latin American Context

This panel will provide a state of play of beneficial ownership in Ibero-America. A panel of experts from the region as well as from other countries internationally will discuss lessons learned and best practices in beneficial ownership transparency.

PANEL 2 (September 28th, 2022)

Transparency Mechanisms to Combat Tax Fraud in the Region and the World: Experiences and Proposals

This panel will address the importance of transparency mechanisms in combating tax fraud. In addition, panelists will discuss national cases, international conventions, registries, and ideas to strengthen tax transparency going forward.